Win

NES Member

I’m hearing dollar continuing to rise putting downward pressure on metals for next couple months. For those concerned about near term price action it might be best to go on a long fishing trip ![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

If you enjoy the forum please consider supporting it by signing up for a NES Membership The benefits pay for the membership many times over.

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

I was saving up to get it gold plated

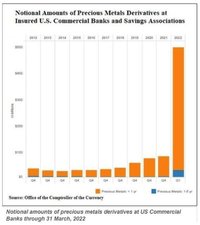

A good article on how the price of gold is being suppressed with paper manipulation despite record sales and deliveries of physical gold.

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Of if you're lazy, the most important chart showing you how bad the economy and inflation are right now:

View attachment 636823

I think it is because they only have Q1 data for 2022?Hmm, why are all the low ones Q4? Looks misleading.

Better to buy junk silver, or stuff like the above for:Grabbed another roll at $24.25/oz. earlier today. Deal's gone now or I'd double-down...

roughly SPOT + $5

View attachment 634251

ASE's, Maples are tops, then other Governmental "coins" next like the Phils/Krugs/Pesos/Kooks/Pandas, lastly for rounds Engelhard Prospectors are good to go.If the above, are any certain "rounds" more "legit" than others?

bars too...

bars too...Inflation report 9.1%, but gold drops in price.

You don't need any more proof markets are rigged by government.

![Laugh [laugh] [laugh]](/xen/styles/default/xenforo/smilies.vb/012.gif)

Higher inflation should lead to higher rates which leads to better options for investing in bonds. Gold will spike as soon as they have to cut rates and resume the printing.Inflation report 9.1%, but gold drops in price.

You don't need any more proof markets are rigged by government.

Anyone find any gold out there for spot price yet?

Ummm…in the ground?Anyone find any gold out there for spot price yet?

Damnit…you beat me to it.I’ve got a hole on the ground full of gold below spot. Wanna buy it?

I’ve actually been thinking about this and all my teeth are fine. Great way to transport your PM’s though.

I dunno, but the ones that seem to be the most cost-effective are the floaters...This is the time of year that the "Gold Rush" folks are mining up in Alaska.

What's their biggest cost??? Fuel. And the cost of fuel is double last year (give or take).

At some point it has to squeeze their margins to the point that it's not worth the risk without accompanying higher gold prices. Supply and demand.

Will be interesting to see. And Tony Betts and his floating dredge gizmos has the lowest fuel and labor costs and highest profit margins.

In a naturally, self-controlling free market, the rate to gold ratio would be true.

There is nothing that says the Fed is going to raise rates to control inflation. Does anyone here think the Fed will raise rates to 10%? If the answer is no, the your logic is severely flawed.

This is the time of year that the "Gold Rush" folks are mining up in Alaska.

What's their biggest cost??? Fuel. And the cost of fuel is double last year (give or take).

At some point it has to squeeze their margins to the point that it's not worth the risk without accompanying higher gold prices. Supply and demand.

Will be interesting to see. And Tony Betts and his floating dredge gizmos has the lowest fuel and labor costs and highest profit margins.

any more details? or, would you like to keep it on the hush? Either way's good...Just now bought Canadian Maple Leafs at $24.66 including all fees. Beautiful coin...